Introduction

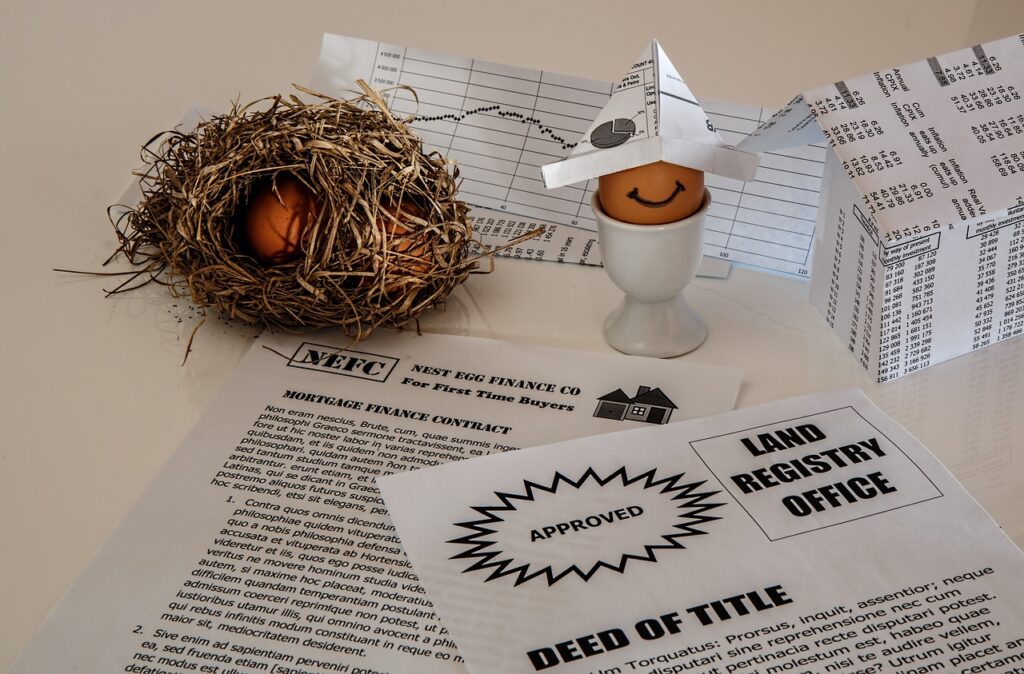

Are you tired of juggling multiple bills, struggling to make ends meet, or dreaming of embarking on that long-awaited adventure? Well, fear not, because I’ve got just the thing for you – the Best Egg Loan! Picture this: a hassle-free application process, competitive rates, and funds deposited into your account within days. Intrigued? Keep reading as we dive deep into the world of Best Egg Loans and discover how they can be your ticket to financial freedom!

What’s the Buzz About Best Egg Loans?

You might be wondering, what sets Best Egg Loans apart from the rest? Well, let me tell you – it’s all about simplicity, speed, and savings! Here’s why:

- Simplicity: Say goodbye to mountains of paperwork and endless wait times. With Best Egg Loans, the application process is as easy as pie. Just fill out a simple online form, and you’re good to go!

- Speed: Need cash in a hurry? Best Egg Loans have got you covered. Unlike traditional lenders who can take weeks to approve a loan, Best Egg Loans offer fast approval and funds deposited directly into your account within days.

- Savings: Who doesn’t love saving money? With Best Egg Loans, you’ll enjoy competitive rates that won’t break the bank. Plus, with flexible repayment options, you can tailor your loan to suit your budget.

How Does It Work?

Curious about how Best Egg Loans actually work? It’s simple, really! Here’s a step-by-step breakdown:

- Application: Start by filling out an online application. It only takes a few minutes, and you’ll need to provide some basic information like your income, employment status, and desired loan amount.

- Approval: Once you’ve submitted your application, our team will review it and make a decision. If approved, you’ll receive a loan offer detailing the terms and conditions.

- Funding: Upon accepting the loan offer, the funds will be deposited directly into your bank account within days. No waiting around or jumping through hoops – just fast, convenient cash when you need it most!

FAQs: Your Burning Questions Answered!

Crack the Code to Financial Freedom with the Best Egg Loan!

- How much can I borrow with a Best Egg Loan?

- Best Egg Loans offer loan amounts ranging from $2,000 to $35,000, depending on your creditworthiness and financial situation.

- What are the eligibility requirements?

- To qualify for a Best Egg Loan, you must be at least 18 years old, have a valid bank account, and meet certain income requirements.

- How long does it take to receive funds?

- Once approved, funds are typically deposited into your account within 1-3 business days.

- Are there any fees or hidden costs?

- Best Egg Loans are transparent about their fees, which include an origination fee ranging from 0.99% to 5.99% of the loan amount.

- Can I pay off my loan early?

- Absolutely! Best Egg Loans allow you to pay off your loan early without incurring any prepayment penalties.

Conclusion: Your Ticket to Financial Freedom Awaits!

Crack the Code to Financial Freedom with the Best Egg Loan!

Who doesn’t love saving money? With Best Egg Loans, you’ll enjoy competitive rates that won’t break the bank. Plus, with flexible repayment options, you can tailor your loan to suit your budget.

So, there you have it – the scoop on Best Egg Loans and how they can transform your financial outlook. Whether you’re looking to consolidate debt, fund a home renovation, or take that dream vacation, Best Egg Loans offer a hassle-free solution with competitive rates and speedy funding. Don’t let financial stress hold you back – crack the code to financial freedom with the Best Egg Loan today!